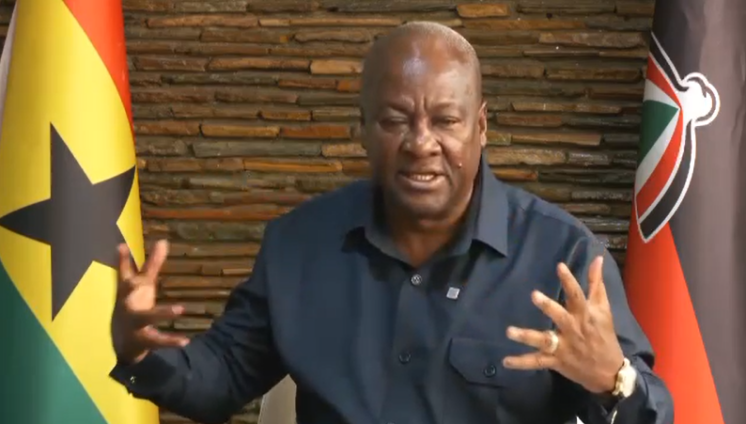

John Dramani Mahama’s concerns about Ghana’s energy sector highlight the crucial link between stable energy supply and economic growth. His call for urgent reforms reflects the pressing need to address persistent challenges such as power generation deficits, inefficiencies in distribution, and the financial struggles of utility companies. The warning about the sector’s fragility underscores the broader risk it poses not only to economic stability but also to industrial growth, job creation, and overall development.

His comments during the meeting with Canada’s High Commissioner, Myriam Montrat, also suggest the potential for international partnerships in tackling these challenges. Canada has a history of collaboration with Ghana on energy and development projects, and this visit could indicate opportunities for bilateral cooperation to bring in technical expertise or investment. John Mahama’s remarks reflect a sharp critique of the outgoing administration’s handling of Ghana’s economic recovery, especially regarding the energy sector and the country’s debt challenges. By likening the energy sector to a patient needing “urgent surgery,” he emphasizes the sector’s critical role in sustaining economic activity and the potential consequences of neglecting it.

His focus on the $2.5 billion energy-sector debt versus the $3 billion bailout highlights what he perceives as a mismatch between the scale of the problem and the government’s proposed solutions. This critique not only questions the credibility of claims about economic improvement but also underscores the systemic nature of the debt issue, which could undermine long-term recovery efforts if not addressed comprehensively.

Mahama’s commitment to reforms signals a broader intention to tackle inefficiencies and restore public trust in governance. However, translating these promises into actionable plans will require significant political will, stakeholder engagement, and possibly international support. John Mahama’s warning about the energy sector debt as an “economic ticking time bomb” underscores the urgency of addressing systemic financial challenges that could derail Ghana’s economic recovery. By framing it as a threat capable of negating progress, he paints a stark picture of the potential fallout if the issue remains unresolved. This reinforces the idea that Ghana’s energy sector woes are not just technical but deeply tied to the country’s broader economic stability.

His critique of the outgoing administration’s “optimistic economic narrative” suggests he views it as a façade aimed at preserving political credibility rather than reflecting the reality on the ground. By highlighting the risk of the debt burden “crushing” any economic gains, Mahama is calling for a more honest and practical approach to fiscal management.