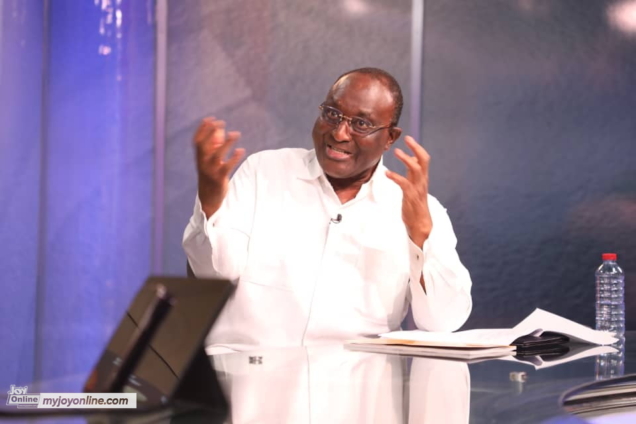

During the Movement for Change’s Caravan Tour in Kwabenya, Greater Accra Region, Senior Advisor and Director of Election Planning for the Movement, Nana Ohene-Ntow, announced that Alan Kyerematen, if elected President of Ghana, would abolish the controversial COVID-19 tax along with other “nuisance taxes” that he described as unjust burdens on Ghanaians. Ohene-Ntow criticized these taxes as impediments to business growth, arguing that they add unnecessary financial strain on both individuals and enterprises.

He pointed out that the COVID-19 tax, originally introduced as a temporary measure to address the economic challenges posed by the pandemic, has persisted long after the crisis. According to him, it is “highly unthinkable” that Ghanaians are still required to pay this tax year after the pandemic has subsided. The continued imposition of the tax, he argued, has become a “permanent fixture” that is stifling business activity and putting extra financial pressure on citizens. The promise to abolish the COVID-19 tax and other similar charges forms a key part of Alan Kyerematen’s campaign platform, which seeks to alleviate the tax burden on Ghanaians and create a more conducive environment for business and economic growth. The Movement for Change, which supports Kyerematen’s presidential bid, is pushing for reforms that would ease financial burdens and encourage entrepreneurship as part of a broader strategy to boost the country’s economic recovery and development. Nana Ohene-Ntow, speaking on behalf of Alan Kyerematen’s Movement for Change, reiterated the plan to abolish not only the COVID-19 tax but also other “nuisance taxes” that have been detrimental to businesses, particularly those levied at Ghana’s ports. He highlighted the negative impact of these excessive taxes and charges, which he said are “crippling businesses” and stifling economic growth. According to Ohene-Ntow, Alan Kyerematen’s administration would eliminate these burdensome taxes to foster a more conducive and profitable business environment, promoting growth and innovation.

The COVID-19 tax, which was introduced in 2021 to help support healthcare infrastructure and finance the country’s vaccination efforts during the pandemic, was initially accepted as a necessary temporary measure. However, Ohene-Ntow argued that its continued imposition is now unwarranted, given that the pandemic is largely behind us. He criticized the persistence of the tax as unjust, stating that Ghanaians should not still be paying for a crisis that no longer exists.

By committing to abolishing the COVID-19 tax, Kyerematen’s campaign aims to prioritize the needs of ordinary Ghanaians, alleviating the financial burden on individuals and businesses. The plan to reform the tax system, particularly about port charges, is intended to create a business-friendly environment that encourages economic activity, supports local industries, and attracts investment. The promise to remove these taxes is part of a broader economic strategy that seeks to ease financial pressure on citizens and stimulate the country’s economic growth. Nana Ohene-Ntow, representing the Movement for Change, outlined a comprehensive economic reform agenda under Alan Kyerematen’s leadership, focusing not only on tax relief but also on broader measures to stabilize Ghana’s economy. He highlighted plans to reduce inflation, interest rates, and exchange rates to single-digit figures, which would make the cost of borrowing more affordable and stabilize the value of the cedi. According to Ohene-Ntow, achieving these targets is crucial for creating a business environment where local enterprises can grow, generate employment, and improve the standard of living for Ghanaians.

He argued that the reforms would go beyond merely abolishing burdensome taxes, aiming instead at restructuring the economic landscape to foster sustainable development. The reduction of inflation and interest rates, coupled with a more stable exchange rate, is expected to lower the cost of doing business, enhance profitability for local companies, and attract foreign investment.

Ohene-Ntow also criticized the government’s failure to discontinue the COVID-19 tax despite it no longer serving its original purpose of supporting pandemic-related healthcare needs. He characterized the tax as evidence of a disconnect between the government and the everyday struggles faced by Ghanaians. The continued imposition of the tax, he suggested, reflects a lack of responsiveness to the evolving economic realities.

By prioritizing the abolition of “unfair taxation” and implementing smart economic policies, the Movement for Change aims to present Alan Kyerematen as a leader who listens to the concerns of the people and is committed to making governance work for the ordinary citizen. Nana Ohene-Ntow concluded his remarks by urging voters to embrace the economic relief and comprehensive reforms outlined in Alan Kyerematen’s Great Transformational Plan (GTP). He emphasized that the GTP offers a vision for a competitive Ghanaian economy by implementing tax reforms, reducing excessive financial burdens, and supporting local businesses. According to Ohene-Ntow, the plan aims to eliminate barriers that hinder economic growth, making it easier for businesses to thrive and generate employment opportunities.

He reiterated that under Kyerematen’s leadership, Ghanaians could expect a future where high taxes, interest rates, and inflation no longer stifle business activity or the livelihoods of citizens. By committing to policies that target these economic challenges, the Movement for Change intends to foster a more favourable environment for entrepreneurship and investment.

The Great Transformational Plan seeks to position the economy for sustainable growth, driven by local innovation and a more business-friendly landscape. As the caravan tour continued across the region, Ohene-Ntow’s message aimed to galvanize support for Kyerematen’s economic agenda, presenting it as a path to a more prosperous and resilient Ghana.